As the sterling takes a tumble investors are looking for a safe haven following the post-Brexit vote and a surprising emergence is the fine wine market.

Investing in vintage goods tend to be stronger when the pound is weaker, and in the weeks since the vote the pound has fallen to a 31-year low. Since leaving the European Union the weaker sterling has increased the demand for wine by making it cheaper to purchase in foreign currencies, increasing overall demands abroad.

The Wine Investment fund discussed that although Bordeaux sourced wine investments are purchased in sterling the majority of buyers are based abroad such as China, Japan and the USA.

Since 2011 to 2014 the fine wine market suffered a 36% price correction following a lengthy period of declining prices with an almost flat 2015.

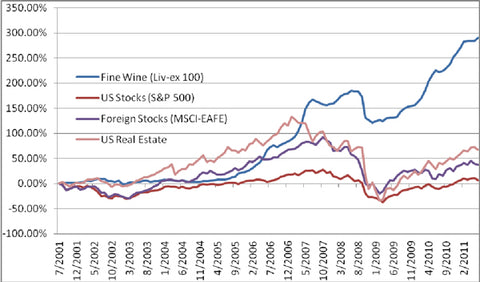

The wine investment also added that investments have delivered annual returns of almost 7% since 2003 and prices have increased by 7% since.

The wine investment also added that investments have delivered annual returns of almost 7% since 2003 and prices have increased by 7% since.

"Asset markets are likely to be volatile and challenging to navigate while everyone comes to terms with the implications of the referendum," Andrew della Casa, director of the Wine Investment Fund, said.

"But there are good reasons to think that wine may benefit from the uncertainty: it is physical, and tends to perform better when Sterling is weak. Add in its excellent long-term track record and favourable cyclical position, and it is one asset for which the future looks bright."

The Wine Investment fund disclosed to City A.M that on average each investor from its list of 400 investors will invest £40,000 pounds with investment increasing the further East you go. Investors in Hong Kong and China will invest much more overall compared to those in the West.

The fine wine market is usually home to the high net-worth individuals (HNWIs) and management funds as stocks across the board tend to outperform in times of market uncertainty.

The shares of alcoholic drinks giant Diageo and cigarette makers British American Tobacco (BAT) and Imperial Brands have all outperformed since the Brexit vote announcement on Friday.

No comments:

Post a Comment